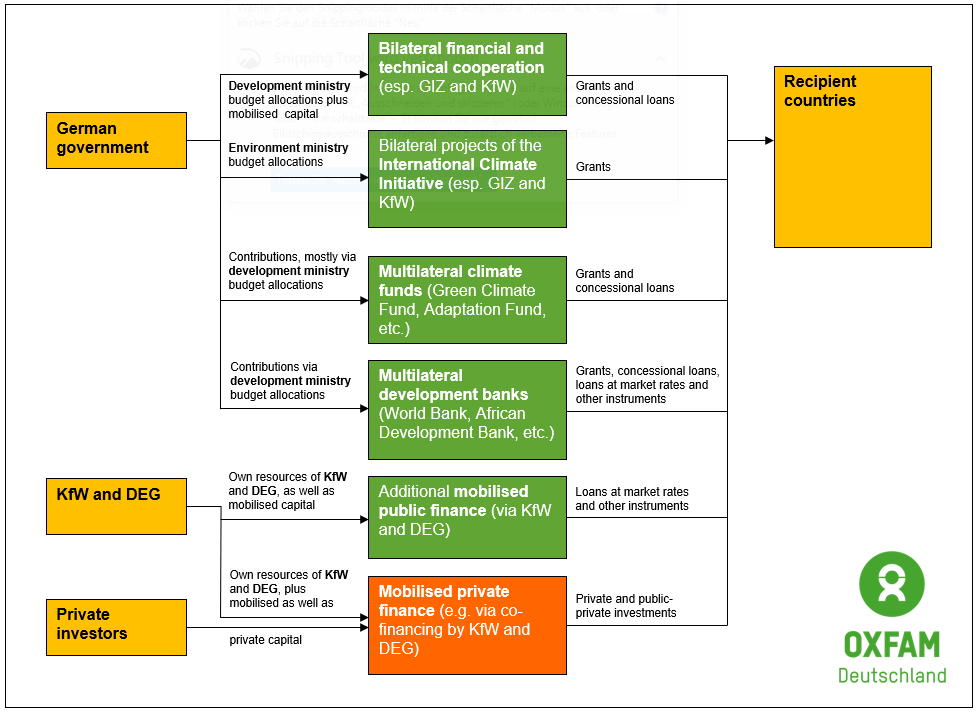

The funding for climate finance in Germany is coming mainly from the federal budgets of the Federal Ministry for Economic Cooperation and Development (BMZ) and the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) and are channeled through bilateral projects and programmes or regular payments to multilateral climate funds and multilateral initiatives. In addition, Germany contributes to the budgets of Multilateral Development Banks (MDBs) which in turn fund projects for climate change mitigation and adaptation. And finally, Germany aims at mobilizing private investments with targeted interventions.

Bilateral channels

The largest share of German funds for climate change financing (approximately 85% in 2015/2016) are disbursed through bilateral development cooperation. The funding is divided into the technical cooperation implemented by Gesellschaft für internationale Zusammenarbeit (GIZ) and the financial cooperation implemented by KfW Development Bank. These funds are distributed via the financial instruments applied by development cooperation, i.e. grants, loans at preferrential conditions, loans at market conditions and (to a limited degree at least currently) shareholdings.

The German Environment Ministry (BMU) has a separate funding mechanism with the International Climate Initiative (IKI) which is funding projects for climate change mitigation and adaptation, and building strategic alliances with countries. The ICI generally only gives out grants.

Multilateral climate funds

The other share of the German climate finance (around 15% of public funding in 2015/2016) is covered by contributions to several multilateral climate funds. Some of these funds were established directly under the UN Framework Convention on Climate Change or the Kyoto Protocol and now serve under the Paris Agreement:

- The Green Climate Fund (GCF) which has only been funding projects since 2016 and which is supposed to develop into one of the main channels for climate finance.

- The Adaptation Fund (AF) under the Kyoto Protocol which finances adaptation projects in developing countries.

- The Least Developed Countries Fund (LDCF) which is supporting LDCs, especially in financing their National Adaptation Programmes of Action (NAPA).

- The Special Climate Change Fund (SCCF) which is funding mitigation and adaptation projects in developing countries.

Other funds exist outside of the UNFCCC, but follow similar goals:

- The Climate Investment Funds of the World Bank, including the Clean Technology Fund (CTF) supporting the dissemination of climate friendly technologies for mitigation and the Pilot Programme for Climate Resilience (PPCR) supporting adaptation strategies

- The Forest Carbon Partnership Facility which is supporting developing countries in reducing emissions from deforestation.

- The Global Environment Facility (GEF) which is providing financing for the implementation of the Rio conventions in developing countries including the UN Framework Convention on Climate Change (UNFCCC).

- The Montreal Protocol Fund which is supporting measures for reducing ozone depleting substances in developing countries.

Germany pays its contributions to these funds generally as grants, with the exception of the contribution to the Clean Technology Fund which is paid as a loan. Many of the funds use donor country contributions for grant-based funding, other funds (in particular the Climate Investment Funds and the Green Climate Fund) also administer loans.

Multilateral initiatives and programmes

Germany also makes contributions to multilateral programmes and initiatives where donor and/or recipient countries rally together around a common issue. They are an important means for industrialized countries to fulfill their international climate finance obligations, even though not all pledges to these initiatives is actually additional money; some only represent a new aggregation of existing pledges. Two initiatives where Germany is an important actor are the InsuResilience Initiative for climate risk insurance which was founded as part of the G7 and extended through the InsuResilience Global Partnership, and the African Renewable Energy Initiative (AREI), an Africa-led effort to accelerate and scale up the continent’s renewable energy potential.

Development Banks

Germany also channels part of its climate finance via development banks which next to their original objectives are increasingly funding climate change mitigation and adaptation in developing countries and emerging economies. This includes the German development bank KfW, but also multilateral development banks like the World Bank or the African Development Bank. The banks can fund many projects and programmes through equity which is used to mobiliza additional funds from the capital market and in order to provide loans to large-scale programmes. The German government makes regular payments to the general budgets of the MDBs and therefore makes an indirect and partial contribution to the funded programmes and measures.

Climate financing through leveraging private capital

Another ongoing development in international climate politics is that public actors are taking targeted actions for the mobilization of private capital and investments. like the Global Energy Efficiency and Renewable Energy Fund (GEEREF) or the Global Climate Partnership Fund, which the German government initiated together with Denmark, Austria, the World Bank and the Deutsche Bank, as well as other activities of KfW subsidiary DEG.