German climate finance / Transparency

Greater transparency in German climate finance in 2015

In 2015, Germany committed a total of around €2.7 billion for climate protection and adaptation to climate change in developing countries. About €2.31 billion of this comes from bilateral development cooperation and €371 million from multilateral funds and development banks. These resources originate in the budgets of the Federal Ministry for Economic Cooperation and Development (BMZ) and the Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB).

The distribution of these financial commitments into projects, programs and payments to multilateral funds are now also recorded in our project database on the German part of the website combined with additional information which we have collected from different sources. Where possible, independent project information and analyses linked to the projects are being published for individual projects in the forest conservation/REDD+ sector such as the Climate Protection through Avoided Deforestation (CliPAD) program in Laos.

Improved transparency in the German government’s reporting

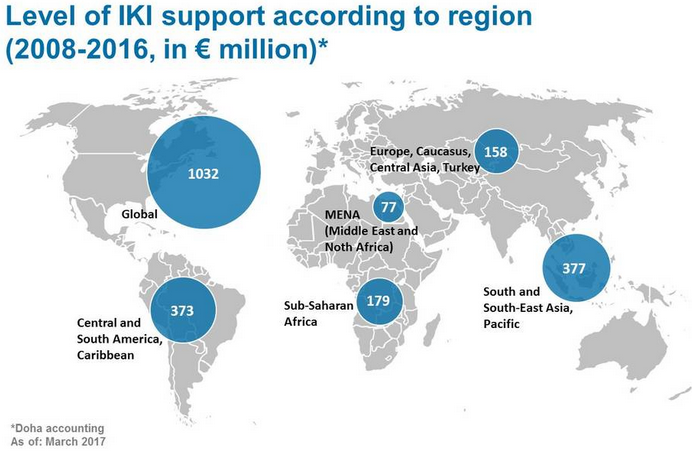

As in the past transparency remains a problem – many pieces of information are difficult to collect. In addition, BMZ and BMUB are still reporting their climate finance measures separately and in a non-uniform manner, even though both ministries have to report their data together within the scope of international reporting (e.g. to the European Union as part of the Monitoring Mechanism Regulation, MMR). This would in fact permit a joint presentation also for the German public. Yet, BMZ presents its climate finance for the latest year in which project information is published (here 2015, see figure 1), while BMUB summarizes its funding from 2008 to 2016 (see figure 2). This restricts a direct comparison between the two ministries.

Fig. 1: BMZ climate finance. Source: BMZ website

Fig. 2: BMUB climate finance via the International Climate Initiative (IKI). Source: ICI website

Despite justified criticism the German government’s reporting has become notably more transparent in recent years, and these efforts continue with changes made this year. For example, the BMZ provided links to project descriptions on the GIZ website for the projects it approved in 2015 and referred to the KfW project portal, which also contains some project descriptions. This is an important step that will allow greater insight into what the German government is supporting with its climate finance. And it allows a better analysis of the quality of the projects implemented.

A further innovation is that starting with the year 2015, the BMZ also provides a list of specific projects for loans granted by KfW. It specifies the market funds that flowed into the individual projects, for the most part as development loans financed by public funds. This is an improvement, even if only the mobilized market funds are allocated to individual projects, but not KfW’s interest subsidies, which are only stated as a total.

Monitoring German climate finance

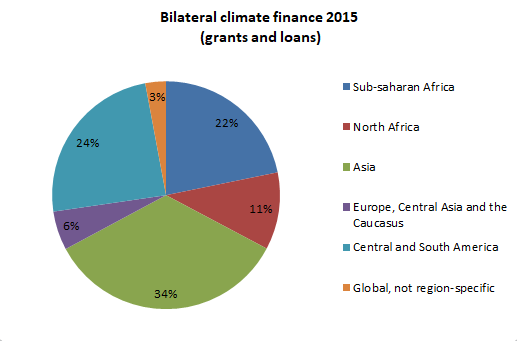

With our database we have compiled the relevant information and can make some interesting observations. Of the committed grants a total of 39 percent of German climate finance went to Africa in 2015. Africa is thus the top recipient, followed by Asia and Central and South America with 15 percent each. This largely corresponds to the weighting presented on the BMZ website, but the incorporation of the funding by BMUB and a more precise regional distribution that includes North Africa as well as Europe, Central Asia and the Caucasus result in some deviations. These deviations are even sharper when loans are included into the picture (see figure 3). In this case Africa’s share is reduced to 24 percent while Asia receives the largest share of climate-related funding with 34 percent.

Fig. 3: Bilateral climate finance 2015. Source: project database, June 2017

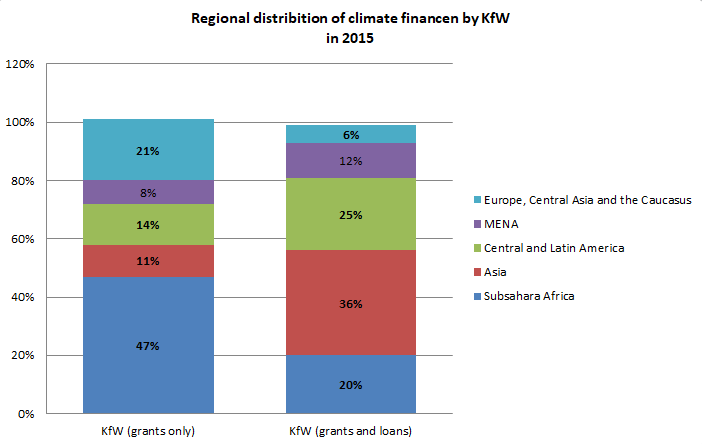

The database also enables us to analyze the distribution of the funding commitments by the implementing agencies, most notably GIZ and KfW. The regional distribution of the grants committed shows a clear focus on Africa. This is more pronounced for KfW where 47 percent of the funding goes to Africa compared to a third of GIZ funding. Yet when loans are included into this calculation, Africa’s share is reduced to 20 percent for KfW funding while funding to Asia rises to 25 percent (see figure 4).

Fig. 4: Regional distribition of climate financen by KfW in 2015. Source: project database, June 2017

The sectoral distribution of the grants committed between mitigation, adaptation and forest protection/REDD+ also shows a difference between GIZ and KfW. GIZ committed almost half of its funding (47 percent) to projects supporting the adaptation to climate change. In contrast, only 36 percent of KfW’s grants are going to adaptation projects. Forest protection/REDD+ represents 10 percent of both institutions’ climate finance portfolio. However, integrating the loans into the calculation of KfW’s sectoral distribution increases the share of funds dedicated to climate change mitigation to 83 percent, while adaptation projects only receive 14 percent.

DEG black box

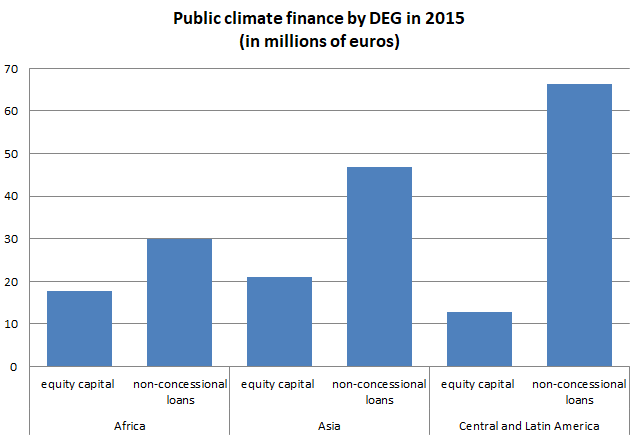

The situation is different for the Deutsche Investitions- und Entwicklungsgesellschaft (German investment and development association, DEG). For the KfW subsidiary, the loans are only broken down according to concessional development loans, which are accounted for by official development assistance (ODA), and non-concessional loans not related to ODA. The argument for this non-disclosure is the trade secret of the supported companies.

Figure 5: Public climate finance by DEG in 2015. Source: project database, June 2017

It remains thus unclear into which projects the DEG funds flow. That, however, would be the key to independent civil society review. This is not only important for the quality of the individual projects, but also for the question of the quality of German climate finance – i.e. which projects are being supported in the name of the German contribution toward global efforts to protect the climate and adapt to climate change. The example of Lake Turkana, in which DEG has been involved since 2014 and which has been criticized repeatedly in recent years because of violations of local residents’ rights, shows how critical this can be. A similar case is the Barro Blanco hydroelectric dam in Panama.

Climate finance for the implementation of the Paris Agreement

If the German government wishes to contribute to the implementation of the Paris Agreement with its climate finance, the project portfolio must be aligned with the agreement’s criteria. This means that the German government also needs to include its loans into the calculation of the regional and sectoral distribution of German climate finance – and to aim for a balance between mitigation and adaptation. And the debate over quality requires transparency, also with regard to DEG projects counted toward climate finance that are used extensively to promote mitigation projects in developing countries. These demands are supported by the database as a monitoring instrument of civil society for the scope, quality and transparency of German climate finance.

Christine Lottje