Loss and Damage

Debt relief in response to loss and damage caused by climate change

Severe storms inflicting considerable damage on affected countries or regions are nothing new. However, there is every indication that global warming will make extreme weather events such as hurricanes, droughts and floods more frequent and more intense. Between 1998 and 2017, this resulted in damage amounting to USD 2.908 trillion worldwide, more than double the damage in the two previous decades combined. In absolute terms, most of this damage is in industrialized countries – not because they are more severely and more frequently affected, but because buildings, vehicles and infrastructure facilities there are more expensive than their equivalents in poorer countries.

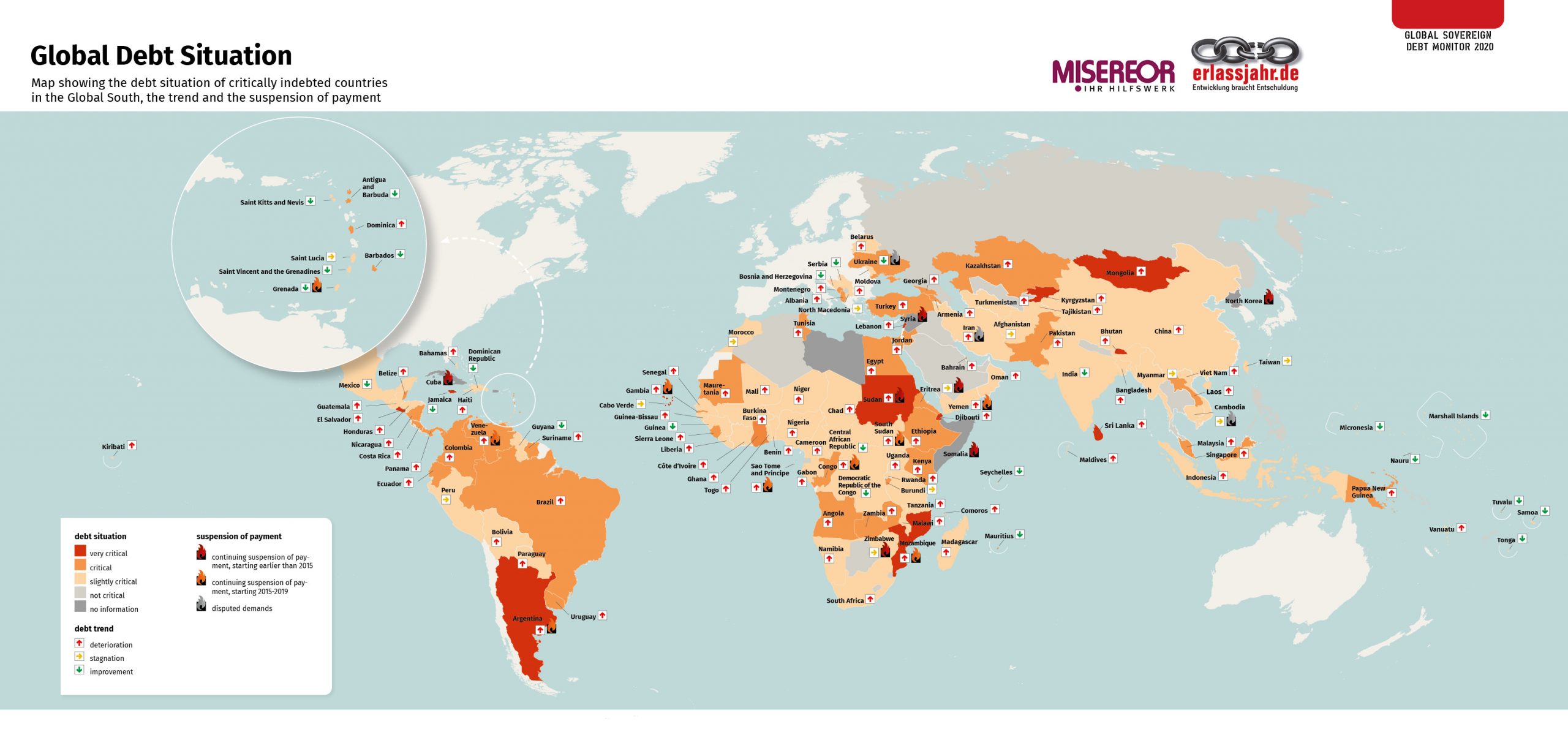

Comparing a map of the countries most severely affected by climate change with a map of the most heavily indebted countries does reveal an incomplete but discernable congruence between the threat of climate change and impending or existing over-indebtedness. It is therefore plausible that there are calls for the use of debt relief to finance climate change adaptation mitigation measures in the movements for climate justice and global debt.

Debt relief for adaptation and mitigation?

The two main strands of the climate finance debate – adaptation and mitigation – face considerable allocation problems, however. For example, an alternative bank that only invests sustainably can have a repayment claim related to a state-guaranteed project in a debtor country that is at high risk in connection with climate change. Both adaptation and mitigation urgently need to be financed – regardless of whether a country still has considerable fiscal leeway or is already on the brink of a debt crisis. Cancelling or reducing the alternative bank’s claim would nevertheless be a questionable approach, considering that this particular investor has already done everything humanly possible to mitigate climate change or to reduce its impact through a suitable project.

In view of such allocation problems, it would be make sense to finance both climate change adaptation and mitigation measures externally through newly mobilized funds. Debt relief for this purpose is only useful – if at all – in exceptional cases or to a limited extent using special instruments such as debt-for-climate swaps.

This is not the case, however, with regard to a third strand of climate finance, namely dealing with loss and damage arising from climate change.

Debt relief to compensate for loss and damage

Dramatic disasters that are brought about or significantly intensified by climate change often trigger fiscal crises in the affected countries, when states are not in a position to mobilize resources necessary for immediate disaster relief and the first phase of reconstruction themselves. The smaller the affected country, the less likely it is to be able to do so, since, in the case of small island states, hurricanes always affect the country as a whole, while larger countries are somewhat better able to cope with comparable natural disasters because they can access resources from unaffected regions. If states then try to close the resulting gap through credit financing, they face a debt trap, i.e. a stabilization of their debt indicators at a high level. Countries cannot simply grow out of this situation, because too much of the achievable surplus is absorbed by debt repayments and interest. Once a critical level is reached, deficits can only be covered by new borrowing, which in turn drives up debt indicators further, and the debt trap set by the external shock of a natural disaster thus snaps shut.

Since a debt crisis can arise virtually automatically and overnight as a result of a climate shock, the instrument of debt relief is appropriate here. The Jubilee Caribbean debt relief network has shown how this can work in concrete terms in the form of a debt relief initiative for heavily indebted Caribbean island states. In the event of a natural disaster – and only then – it would transform existing debt, i.e. the debt service already planned in public budgets, into an instrument of emergency and reconstruction aid.

Debt relief thus has the potential to provide direct access to resources that are already in the hands of the authorities and therefore do not need be mobilized in lengthy and open-ended pledging procedures. Ordinarily, this would involve foreign exchange held in government-owned accounts as part of public budget management and earmarked for regular debt service to foreign creditors. Such funds would then be used for disaster relief and reconstruction instead of their originally intended purpose. The budgeted debt service would thus assume the role of the special foreign exchange reserves for emergencies recommended by the international financial institutions. This reallocation of ongoing debt service would at the same time have a dampening effect on the inevitable new debt.

In practical implementation, such an option would involve two steps:

- a moratorium, which would make the entire budgeted debt service to all creditors available for the financing of emergency measures in the short term, and

- a debt rescheduling process that would enable the country’s total external debt to be rescheduled as needed to reach a point where the country, given its vulnerability, is unlikely to fall back into over-indebtedness in the short term.

The individual steps:

- The country affected by the disaster immediately applies to a previously identified international institution for a moratorium.

- The institution considers the application on the basis of the information available and approves the moratorium within a period of two to a maximum of seven days. The sole criterion for this approval is the amount of damage incurred in relation to a previously defined critical threshold. The decision would be a simple “yes” or “no” without any influence on a possible subsequent rescheduling or its scope.

- The moratorium is limited to a given period, which should be six months under normal circumstances. During this period, all payment obligations of the debtor are suspended and no legal action can be taken to enforce debt service.

- A creditors’ committee involving all private and public claim holders vis-à-vis the country concerned is organized within the granted moratorium period and starts negotiations with the debtor country.

- The negotiations include representatives of all creditors and take place under a neutral chair. They end – if it proves necessary – with the restructuring of all liabilities of the debtor country.

The individual steps clearly require two different types of international organizations: For the decisions to be made under steps (1) to (3), technical expertise is required to collect information and draw up a conclusion. In the 2017 Caribbean hurricane season, the World Bank provided this assessment quickly and competently. The World Bank would thus be an option for this role – although certainly not the only one.

Steps (4) and (5), i.e. the assessment of medium-term debt sustainability and the conduct of negotiations between the debtor and all of its creditors, cannot by their very nature be the responsibility of an institution that is itself a creditor.

Rather, the conduct of the negotiation process between the parties must be in the hands of a mediator or a mediation institution that is itself neither dependent on the debtor nor on its creditors. This sounds banal because it is a universal principle of the rule of law. In the real world of sovereign debt, however, this principle is not respected when negotiations are held in forums controlled by creditors, specifically the Paris Club and the IMF.

NGOs such as erlassjahr.de and UNCTAD as well as the academic community have put forward pragmatic proposals in recent years as to how such a neutral authority could be created.

Is such debt relief feasible?

Such a proposal – especially coming from NGO circles – sounds ingenious, but without a chance of realization. In fact, most of the elements of the Jubilee Caribbean proposal have already been a part of debt restructuring in one way or another:

- Hurricanes have already been the reason for (offers of) debt rescheduling in the past. Both private and public creditors have recently included “hurricane clauses” in their debt rescheduling agreements with individual debtors. Private bondholders and the Taiwanese government did so in their 2015 debt rescheduling agreement with Grenada.

- Financial markets can certainly deal with indefinable risks. Bonds whose repayment terms were not fixed but linked to the economic success of the debtor have also been accepted by the markets in the past. While GDP-indexed bonds, for example, still have a very small market share, it is clear that risk sharing is not in principle a K.O. criterion for investors.

- Debt moratoria have been used in the past as finance instruments for immediate emergency aid and to finance initial reconstruction projects. Following the 2004 tsunami in the Indian Ocean, the Paris Club unilaterally declared a moratorium on the affected countries Sri Lanka and Indonesia, in the latter case even against noticeable concerns on the part of the debtor.

- Targeted debt relief for groups of countries in particularly critical situations has been used successfully in the past. The Heavily Indebted Poor Countries (HIPC) initiative by the World Bank and the IMF has shown since 1996 that it is possible to reduce all debts of countries in particularly difficult situations to a sustainable level. Even if the HIPC and the subsequent MDRI initiative were anything but perfect in concept and implementation, they enabled a large number of countries to make a new economic start that would otherwise have been impossible. Furthermore, they demonstrated that it is possible to create a clearly defined debt relief program for a limited group of countries without first requiring a global consensus and mechanism for all countries.

With the April 2020 debt moratorium for poorer countries particularly affected by COVID-19, the G20 demonstrated that debt relief can be useful and effective in extreme economic crises, and not only in individual exceptional circumstances but for groups that have a particular stress situation in common. It would be more than appropriate for the same G20, which accounts for the bulk of the emissions driving climate change, to assume the same responsibility toward its victims. And as we have seen, this can be done with ease.

Guest post: Jürgen Kaiser / erlassjahr.de