International climate finance / Transparency

Is Switzerland making an appropriate contribution to international climate finance?

In recent years, various studies by civil society organizations have taken a critical look at international climate finance. One of these is a recently published study on Swiss climate finance (in German) by Alliance Sud. The study addresses key issues that have been raised several times on www.germanclimatefinance.de in the context of German climate finance. These include whether a country – in this case Switzerland – is making an adequate contribution to the USD 100 billion pledge and whether there is an actual increase in the amount being earmarked for climate finance. It also examines the strategic alignment of the funds for climate change adaptation measures with the situations in the recipient countries. The study focuses on the question of increasing vulnerability due to climate change, and whether and how development and climate finance are linked.

Little new money behind the increase in Swiss climate finance

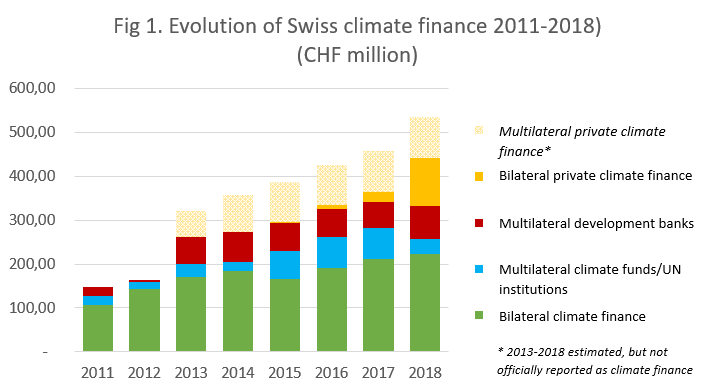

Since 2011, Switzerland’s reported climate finance has tripled to a total of more than CHF 440 million in 2018 (see Fig. 1). The lion’s share, an annual CHF 300 to 330 million, came from public sources; 99% of this stemmed from the budgets of the Swiss Agency for Development and Cooperation (SDC) and the State Secretariat for Economic Affairs (SECO).

However, the significant increase in Swiss climate finance from 2011 to 2018 is only partly due to additional (development) funds made available for climate finance – such as the 2015-2017 payments to the Green Climate Fund (GCF). The bulk of the reported increase is due to changes in accounting practice: The core contributions to multilateral development banks were reported pro rata as climate finance for the first time as of 2013. Furthermore, Switzerland has been reporting additional contributions from “mobilized private sources” to the UN Framework Convention on Climate Change (UNFCCC) for the last few years. In 2018, these jumped to just over CHF 100 million, accounting for almost a quarter of the total Swiss climate finance reported. In contrast, bilateral climate finance has seen a comparatively modest increase. While it still accounted for three quarters of the total Swiss climate finance reported in 2011, its relative share was reduced to half by 2018.

Strong focus on adaptation, but hardly on the poorest developing countries

Switzerland is one of the few countries that clearly prioritize and even exceed the goal of equal distribution of adaptation and mitigation for public bilateral climate finance. Since 2011, bilateral funds have been used to finance more adaptation than mitigation measures, although the trend is declining. In 2017 and 2018, the share of Swiss climate finance allocated to adaptation measures had dropped to 50%. When looking at climate finance as a whole, i.e. including core contributions to multilateral institutions earmarked as climate finance, the share of climate finance explicitly used for adaptation projects only makes up around a third (35%).

However, Switzerland’s climate finance – and even its adaptation finance – is only partially aimed at particularly vulnerable countries. Switzerland is focusing its climate measures largely on middle-income countries. On average, only one eighth of all bilateral Swiss climate finance explicitly went to the developing countries most in need: When using the level of development as a benchmark (least-developed countries – LDCs), it was 13%; measured by average income (low-income countries – LICs), 12%. Around 40% of climate finance was used in country-specific, global or regional programs. Almost half of all Swiss climate finance went to middle-income countries (MICs). With a share of 12 to 13% allocated to LICs or LDCs respectively, Switzerland is clearly behind countries like Norway, which deploys 24% of its climate finance in LDCs or LICs, and also below the international average (18%).

Conflicting goals of climate and development finance

In practice, it makes sense to always implement mitigation and adaptation measures in developing countries in the context of development cooperation. However, a contextual link between climate change and development should not be equated with automatic compliance with the relevant international commitments.

Of the 186 adaptation projects with publicly available project descriptions, less than a third (29%) demonstrably qualify as “adaptation finance” under the OECD criteria (3-step approach of 2016). The rest seem to be more or less climate-adapted development projects. Only around a quarter of the country-specific (i.e. not global or regional) adaptation finance went to countries with a low Human Development Index (HDI) or a poverty rate of over 20%. Most of the climate adaptation funds (44%) went to countries with the lowest poverty rate. That said, 41% of the adaptation projects analyzed were in fact implemented in countries with serious to very serious hunger, above all in African countries. In contrast, only 15% of adaptation finance went to countries with the highest Climate Risk Index (CRI >100), which indicates how severely countries are affected by extreme weather events such as floods, storms and heat waves. A quarter each went to countries with a medium or low CRI.

Of the 89 mitigation projects with publicly available project descriptions, only about one third (31%) also explicitly mention a focus on poor target groups or poverty reduction. In the case of country-specific (i.e. not global or regional) development projects designed to reduce greenhouse gas emissions (mitigation), barely 11% of the climate finance thus designated went to countries with a high poverty rate. 90% of the reported country-specific mitigation finance went to countries with a medium to high development index.

The results make it clear that climate and development tasks are not congruent. Synergies are possible and should always be sought out, but are not always a given. Additional funds are therefore needed to meet climate finance commitments under the Paris Agreement. Only in this way can development finance be fulfilled as an equal and independent commitment (e.g. within the framework of the UN’s 2030 Agenda). If both areas are to be covered at the same time without a corresponding increase in funds, goal conflicts will inevitably arise.

Light and darkness in reporting

Like most other countries, Switzerland overestimates the share of climate finance in its bilateral development cooperation because it uses the so-called Rio markers for this purpose. This approach has long been criticized by civil society because the Rio markers were developed as an indicator of the climate relevance of development projects. They are therefore not a suitable instrument for a monetary assessment of climate finance contributions. Switzerland, however, at least differentiates for a conservative weighting and stronger gradation, which leads to a more precise assessment of the climate relevance and the monetary value of corresponding measures within the bilateral projects than is the case in Germany (see Table 1).

A clear deficit in Swiss reporting, on the other hand, is the lack of a project-based presentation that would show for which measures and projects the resources are used. This has already been criticized by the UN Climate Change Secretariat. The list of projects on which the calculation of bilateral climate finance is based, which Switzerland attached to the last two reports to the UNFCCC, is a first step toward improving transparency. However, it does not allow an exact allocation to the reported values. Furthermore, with regard to “mobilized private climate finance”, the private-sector funds or actors and the instruments used – such as participating interests or loans – are listed. What is missing, however, is information about specific financed investments, their contribution to climate protection and adaptation, the specific contribution of public funds to the implementation of these measures (leverage), and the conditions for the recipients of the investments.

Perspectives for expansion: more private rather than new public funding

For the future, in addition to an even greater reallocation of the existing, stagnating bilateral budgets in favor of climate measures, Switzerland will increasingly take the climate components of the financial flows of multilateral development banks and other institutions into account. It is therefore heading for a purely arithmetical increase in the reported climate finance based on broader crediting methods, instead of providing additional financial resources. Furthermore, it is hoping for a strong increase in the mobilization of private investment. Switzerland is also campaigning for increased eligibility of multilateral and indirect mobilized private climate finance. It thus advocates the use of public funds to improve framework conditions and start-up financing for private investment. This would result in numerous methodological challenges for robust and transparent accounting. The central question here is to what extent private climate investments can actually be attributed to Swiss interventions or (mainly) take place because markets for them exist in the target countries. To this end, not enough public information is currently available.

To date, Switzerland has not used any additional sources of funding outside of the budgets for development cooperation (SDC and SECO) and the “global environment” budget of the Federal Office for the Environment (FOEN). This despite that the fact that polluter-pays sources would be available, such as proceeds from emissions trading, income from climate sanction payments from vehicle and fuel importers, or income from existing carbon and future air ticket taxes. The inclusion of such financial sources would not only reduce the burden on the development budget, but would also lead to longer-term planning certainty for Swiss climate finance contributions.

Potential for improvement in climate finance

The following conclusions, which are also relevant for German climate finance, can be drawn from the study:

- A fair share of the USD 100 billion target should be financed by additional public funds. For this purpose, new and polluter-pays sources of finance should be developed, with which public climate finance can be increased over the next few years.

- A balance between adaptation and mitigation should be achieved for all credited climate finance, i.e. beyond bilateral measures. Support should focus more clearly on vulnerability, particularly in the poorest and most vulnerable developing countries, which otherwise have little access to finance.

- Clear criteria need to be established for a link between climate and development measures, and in particular their simultaneous financing, in order to meet the strategic requirements of the Paris Agreement and 2030 Agenda.

- Mobilized private climate finance should be used in addition to the fair, publicly financed share of the USD 100 billion target and should only include directly mobilized funds. Indirectly and multilaterally mobilized funds should be understood as part of the global redirection of financial flows (Article 2 of the Paris Agreement) and should therefore not be counted toward climate finance (Article 9).

- Transparent reporting requires project-specific information for public and mobilized private climate finance. For privately mobilized climate finance, the proportion of public funds, the contribution that these funds make to leveraging private funds, and the conditions for the recipients should be made more transparent.

- The criteria for the allocation of Rio markers in accounting practice need improving. With regard to adaptation, the three-step approach recommended by the OECD should be used and also reflected in the public project descriptions.

Guest contribution by Jürg Staudenmann, Alliance Sud / Christine Lottje, FAKT