Coal finance

Financing climate protection while funding coal: is Germany playing a zero-sum game?!

A new films shows G20 coal finance and why to end it. Source: Oil Change / ODI

Last Saturday was the international Day of Action to stop subsidies for fossil fuels. Oil Change International and the Overseas Development Institute (ODI) used the occasion, on the eve of the G20 Summit in Turkey, to release their study of G20-government subsidies for fossil-fuel production (coal, petroleum and natural gas). Back in 2009, these countries voiced their commitment to ending exactly this type of public financing, but the current figures tell a different story: spending is once again high, at $452 billion dollars per year.

Country-specific case-studies for Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, Great Britain and the USA provide more precise analyses of the key facts and data.

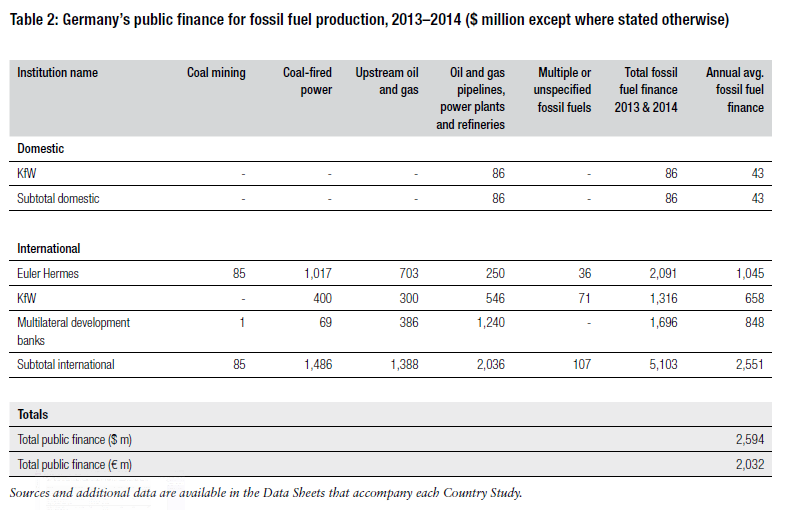

Germany did undertake some divestment measures in the coal industry, restricting financing of fossil fuels in developing countries to export finance issued by the federally-owned KfW-IPEX Bank and DEG corporations as well as government-backed export loans from Euler Hermes AG. But the German case study reveals that in 2013 and 2014, KfW and Euler Hermes spent an average of $2 billion euro annually on fossil fuel production. These funds were used to back projects in Jordan, Brazil, Saudi Arabia, India, Russia, Kosovo, China and Vietnam, among others. Furthermore, international coal finance is a highly non-transparent business, meaning the true figures could, in fact, be much higher.

Source: Oilchange/ODI 2015

In addition, Germany provides an average of $848 million in annual fossil-fuel investment through its contributions to the World Bank, the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB) and regional development banks in Africa, Asia and Latin America. Germany’s investment stake in these operations varies from 1.9 to 16.1 percent. In response to parliamentary questions posed in March and July, it was revealed that Euler Hermes was considering export guarantees for coal-based projects in 15 different countries. These guaranties could be cut back if all OECD countries reduced their support, but this looks unlikely at present.

When this level of funding is measured against German investment in climate protection and climate change initiatives for developing countries, the conclusions are sobering: publicly declared financing for fossil-fuel production alone is roughly equal to the €2 billion of Germany’s climate finance in developing countries back in 2013. This means that when it comes to climate protection and adaptation to climate change, Germany is essentially undoing its own best efforts.

Lili Fuhr / Heinrich-Böll-Stiftung and Christine Lottje